About Financial Accounting Practice Process + Entry Summary, Super Practical

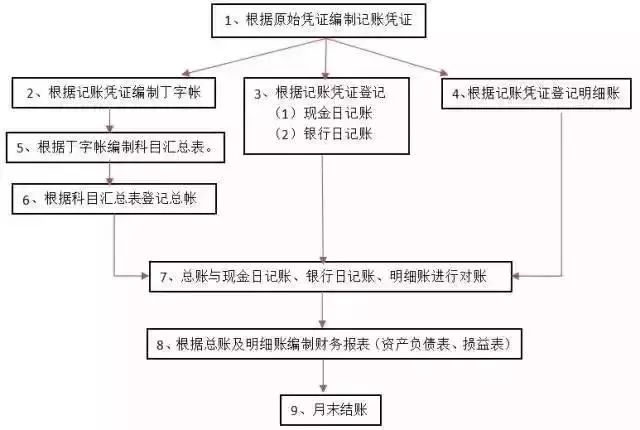

Financial practical process

1, daily cost invoice:

2, payroll:

Staff wage form, there must be a personal signature of each person and have a total total amount.

3, no invoice bank transfer information:

4, no invoice bank transfer remittance:

5, tax category:

Paying taxes such as bank transfers to pay bank remittance orders, such as cash payment to note the cash.

6. Invoices at the time of purchase:

7. Invoices at the time of sale:

In this month, all sales invoices during the month and the outbound banks corresponding to the invoices and the transferred bank remittance order are arranged in sequence according to the date of the date.

做会计分录1. Do your day-to-day fee classification:

Borrow: enterprise management fee

Loan: Cash (in the invoice, the cash payment)

Borrow: enterprise management fee

Loan: Bank deposit (invoice has a bank remittance list)

Borrow: enterprise management fee

Loan: Other payables (written unpaid on the invoice)

2, do a salarie class: generally pay cash

Borrow: enterprise management fee

Loan: cash

Borrow: enterprise management fee

Loan: Bank deposit

3, do the invoice bank transfer message:

These are generally a separate bank to enter the transfer bill, which can be divided into three categories according to the nature described above.

1) Sold (the invoice has been opened and the account is made), do the transcription:

Borrow: Bank deposit

Loan: Receive payment --- a unit

2) Not selling, doing transit:

Borrow: Bank deposit

Loan: Pre-receiving payment --- a unit

3) For other matters, transfers, do transit:

Borrow: Bank deposit

Loan: Other payables - a unit

Remarks: In the accounting, it is generally used with the main business to use "Accounts" and "Accounts payable". It is not the main business to use "other receivables" and "other payables" with other units. "This distinguish between the main business is easy to report.

4, do an invoice bank transfer remittance:

These are generally a separate bank's remapping bill, which can be divided into three categories according to the nature of the above:

1) I have purchased (formerly received the invoice), do the transcript:

Borrow: payable goods - one unit

Loan: Bank deposit

2) The last purchase of the invoice, do the transcription:

Borrow: Prepaid account (to find out if the unit is in advance whether it has been in the account, if there is this corresponding subject.)

Loan: Bank deposit

3) For the transfer form for other matters, do the transcription:

Borrow: Other receivables - one unit (also to find out if the unit has been in the account in advance, if there is this corresponding subject.)

Loan: Bank deposit

5, do tax single class:

Taxes, what taxes are to be paid to the tax order: generally divide the four taxes, one is the taxation of the cost, such as: stamp, urban construction tax, education surcharge, etc. One is the tax directly involved in the goods or service costs, such as: business tax, one is the taxation of invoices such as value-added tax, one is taxable: income tax.

1) Transfer and quote:

Borrow: enterprise management fee

Loan: cash

2) Mingcheng taxation and education attached:

Borrow: enterprise management fee

Loan: Bank deposit

3) Interest value tax:

Borrow: Taxes payable --- VAT

Loan: Bank deposit

4) Pay income tax:

Borrow: Dependent profit --- income tax

Loan: Bank deposit

6, doing cash and bank deposits:

1) Do cash from banks:

Borrow: inventory cash

Loan: Bank deposit

2) Cash deposit into bank accounts:

Borrow: Bank deposit

Loan: inventory cash

7, invoices for purchasing:

Next: List of food saFEty Analysis and determination equipment [Introduction of Main Parameters]